3 Things To Avoid When Filing Bankruptcy Fundamentals Explained

Stripping as numerous nonessential purchases as you possibly can from the funds provides you with much more independence to concentrate on paying off credit card debt speedily. Solve $10,000 or maybe more of your respective financial debt

kerkezz/Adobe In all but essentially the most Extraordinary circumstances, there's a chance you're in the position to dig your way out of financial debt with less drastic steps. Consider these cash moves to start crushing your debt at some point at a time.

Take self-paced courses to grasp the basics of finance and connect with like-minded individuals.

Folks, us lawyers are merely a cellphone call absent! I virtually might be sitting down in the middle of a social event, as an attorney, and listen to non-legal professionals give me authorized advice all the time. You should do you, and All your family members a large favor. When you've got a problem that entails the legislation, your well being, or almost every other job, inquire the industry experts who focus on that spot. After all, They are really the gurus in that spot! It’s like me calling an electrician and inform her about my an infection, it just doesn’t sound right!

Although bankruptcy may be able to support with these things, it can be harder if they are finalized in advance of filing bankruptcy.

Display explanation Payment-only fiscal advisors are paid a established charge for his or her products and services. They don't obtain any sort of Fee from the sale of items They're advising on.

You can use The cash to pay back all of your non-house loan debts. Banking institutions could be ready to operate with you even if your credit score score has actually been negatively impacted by credit card debt difficulties if your said intent should be to pay off current debts.

A very powerful cause to incorporate non-dischargeable debts, although, is so your earnings and expenditure calculations might be correct. As reviewed earlier mentioned while in the segment about keeping go collateral, in case you don’t involve these debts, you could’t consist of the quantities you pay for them monthly in the listing of costs.

A not-for-income credit have a peek at this website history counseling agency may be of assistance right here. These companies can suggest you on methods to get from personal debt and help you negotiate with all your creditors. By way of example, a creditor that is certainly unwilling to settle for under it is actually owed may very well be amenable to lowering your curiosity level, making it possible for you to extend your payments out around a longer length of time, or to some other accommodation that could make the credit card debt much easier to repay.

Financial debt consolidation involves combining a number of debts into an individual loan having a reduce curiosity charge. This might make controlling your debts much easier and conserve you money in interest rates. Quite a few approaches to consolidate credit card debt consist of taking out a private mortgage or utilizing a stability transfer bank card.

If you can buckle down now to cope with debt, you’ll provide the economical freedom to accomplish Everything you enjoy later on in everyday life. Retaining this in your mind might click over here make your existing sacrifice truly feel far more doable. Bottom line

Bankruptcy is actually a lawful method created to assistance persons and businesses who will be scuffling with mind-boggling financial debt. It is a strong Software that can provide a clean begin and aid from creditors, but Additionally, it has some downsides that should be meticulously viewed as their website prior to choosing browse this site to file.

Whilst reducing down expenses is a great way to help make extra cash, getting a portion-time aspect gig and devoting All those cash to debt repayment can substantially lower enough time it will require you to remove personal debt fully.

You could possibly take out a house equity personal loan or refinance the home loan when you possess your house and also have good fairness—the worth of your home is bigger than your remaining house loan.

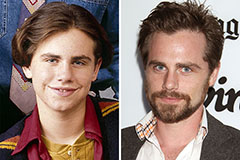

Rider Strong Then & Now!

Rider Strong Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Kane Then & Now!

Kane Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!